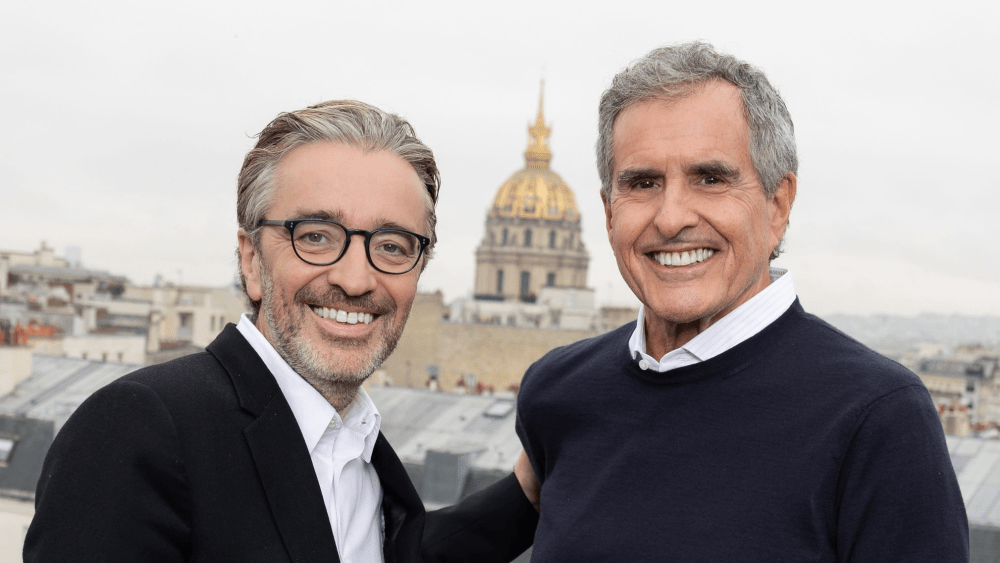

In an era defined by consolidation and scale, Mediawan’s acquisition of Peter Chernin’s North Road Company brings together one of Europe’s fastest-growing content groups and one of the most influential producers in Hollywood, creating what Chernin calls “arguably the most global content company in the world right now.”

Speaking to Variety a few hours after the deal was unveiled, Chernin and Mediawan’s boss Pierre-Antoine Capton argued the merger is rooted in a fundamental shift in the business. “The buyers have all become global,” said Chernin, a longtime media investor and former chairman of Fox who co-founded North Road with Jenno Topping and Jesse Jacobs in 2022. “Netflix, Amazon and Disney are global buying forces and both of us felt that it was important for the producers to become similarly global,” he added.

While North Road is being folded into Mediawan, the acquisition does not dismantle what either side has built. North Road’s labels and management teams remain fully in place, preserving the autonomy that has powered its success across scripted, unscripted and documentary content. Instead, the ambition is to build scale without rather than prioritize cost-cutting. “You never cost-save your way into success,” Chernin said. “You become successful by growing revenues.”

Capton, who landed from L.A. earlier Friday and rushed to Mediawan’s posh offices in Paris, described the acquisition as the culmination of a long courtship and a strategic leap for Mediawan’s global ambitions, notably across English-speaking markets, where the company is already behind Brad Pitt’s Plan B (“Adolescence,” “F1”) and See-Saw Films (“Slow Horses”), and has partnerships with LuckyChap and Springhill. “We are similar companies in terms of what Peter built with North Road and what we built with Mediawan,” said Capton, who is also a leading producer of primetime talk shows in France. “Together we will succeed in bringing the best of Europe and the United States together in one company,” he added. The pairing also balances complementary strengths as North Road is known for its unscripted hits and premium documentaries while Mediawan boasts a deep footprint in European television series and theatrical films.

Capton noted “how much of an impact (Chernin) has had on the industry.” “He’s the person who greenlit ‘Avatar’ and ‘Titanic.’ The entire industry has immense respect for him, and working with Peter is an incredible opportunity for us to take the next step,” he said.

For Chernin, the decision to partner with Mediawan went well beyond financial considerations. “The cultures of the company are very similar,” he said. “Both companies value creativity and prize, in some ways, artists more than anything.” He pointed to Capton’s track record of maintaining creative independence across acquisitions such as Plan B and See-Saw, while quietly building operational synergies behind the scenes. “I couldn’t ask for better partners going forward,” Chernin added.

Chernin also highlighted the strategic benefits of having a Paris-based parent with a powerful U.S. presence. “Talent is global,” he said, noting that different regulatory frameworks and financing models on either side of the Atlantic allow projects to find the most advantageous home.

Chernin and Capton also confirmed the deal was paid mostly in stock rather than cash. As such, Chernin becomes a major shareholder in Mediawan, underscoring his long-term commitment in the banner which was founded a decade ago by Capton, telco billionaire Xavier Niel and financier Matthieu Pigasse. “This isn’t me or North Road cashing out,” he said. “In some ways, this is us investing in Mediawan.”

Your announcement today refers to the creation of a “combined group.” Concretely, what does that mean, given that North Road’s management team and labels remain in place?

Peter Chernin: I think there’s a huge opportunity for a truly global company. And in my opinion, Mediawan is arguably the most global content company in the world right now. There are lots of great content companies, but I don’t think anybody can match that global scale. Mediawan is now the number one independent in France, in Germany and in the United States. Pierre Antoine and I have spent a couple of years talking about this. The buyers have all become global. Netflix, Amazon and Disney are global buying forces. And I think both of us felt that it was important for the producers to become similarly global in order to take advantage of the opportunities in doing that.

Peter, you were likely approached by other major U.S. and international groups. Beyond the financial terms, what ultimately made Mediawan the right partner?

Chernin: Two things were very important to me. One is the culture of the company, and I think we are very similar. Pierre Antoine comes from a creative background, and I come from a creative background. Both companies value creativity and value artists more than anything. When I set out to build North Road, I got Jenno Topping, who is the best movie executive; Chris Coelen, who is the best reality executive; Connor Schell, the best documentary executive. And I think Pierre Antoine has spent the last 10 years doing the same thing on his side. And so there’s a culture of both valuing artists and understanding the nuances of, on the one hand, how to give artists complete creative independence, which, you can see that Pierre Antoine has done that with every company he’s bought as recently as See-Saw and Plan B, and yet at the same time has started to build real business synergies and opportunities between them. So I think on a macro basis, in terms of where the business is going, this felt perfect. And then in terms of the fit of the companies, I think we have the same values.

What strategic advantages do you see in becoming part of a European company headquartered in Paris? How does that change your positioning in the global market?

Chernin: Well, the food’s better, for starters. I think that talent is global and it gives you an opportunity to sort of find the best talent anywhere in the world and then find the best home for that talent. Mediawan brings us talent to Europe, and we bring European talent to the U.S., so on and so forth. So I think that’s a real strategic advantage. And then there are different regulatory opportunities in different countries. There are different financial models in different countries. It’s much easier to have ownership in Europe, which is really important, and probably in the short term it’s easier to get more cash in the U.S. And it gives you an opportunity on a project-by-project basis, to figure out the best home for things. We’ve already done this in some ways, twice. We produced an Academy Award-nominated documentary two years ago called “Super/Man” about Christopher Reeve and we financed it and sold it in the U.S. We also just produced a documentary about Paris Saint-Germain, which we produced out of the U.S. with Mediawan and sold it to Netflix France. So I think those are, you know, two existing examples of sort of the opportunities of joining forces between a European company and an American company.

Pierre-Antoine, I know you looked at different U.S. companies, what made North Road the right fit for Mediawan?

Pierre-Antoine Capton: We are similar companies in terms of what Peter built with North Road and what we built with Mediawan. Both groups were dedicated to independent talent and the quality of what they produced in slightly different genres, with Peter’s side focusing more on unscripted content, with huge hits such as “Love is Blind” and many platform films. We are more focused on TV series and theatrical films, but in different geographical areas. We’ve been talking to Peter for four years. I realized how much of an impact Peter has had on the industry. He’s the person who greenlit ‘Avatar’ and ‘Titanic.’ The entire industry has immense respect for him, and working with Peter is an incredible opportunity for us to take the next step. Even though the group will be called Mediawan, Peter’s ambitions and ours are completely aligned in the success of this combined group. I think that together we will succeed in bringing the best of Europe and the United States together in one company, first creatively and then from a shareholder perspective.

Where do you see synergies emerging within this new combined group?

Capton: First, strategically, we’re going to talk a lot with Peter and all the teams, Jenno and Connor, we want to work with them. Today, the best European talent will talk with all these teams to see what projects we can put together. I think there will be a lot of creative synergy. And then, Peter’s strength will also allow us to have a greater presence in the United States.

How is North Road expected to work alongside Mediawan’s existing labels? Are there specific areas – development, financing, distribution — where collaboration is already planned?

Capton: In fact, each of North Road’s labels is already independent. Kinetic is independent, Words + Pictures is independent. Everyone works autonomously, and Plan B is also completely independent and will continue to work in the same way. So everyone will draw strength from each other. If North Road can contribute something to Plan B, if See-Saw can contribute something to Kinetic, if Chi-Fou-Mi can work with North Road Company, we will do so with great pleasure. Everyone is very excited about the prospect of working together. I have rarely received so many enthusiastic messages from producers on both sides.

Chernin: So many of these deals are focused on cost synergies and there are certainly some cost synergies in this deal. But I think what’s much more meaningful is the opportunity to build aggressively together and it’s part of what appeals to me so much about Mediawan and Pierre Antoine. So many people are focused on how do we get costs out of business. And I’ve done this long enough to know that you never cost-save your way into success. It’s important to be frugal, and I think both companies are frugal, but you become successful by growing revenues. And our entire focus, all through our discussions has been ‘how do we grow the business?’ Not ‘how do we cut costs?’ And by the way, there are, as I said, some costs we can cut, but it’s consistently been ‘how do we grow revenues.” So, Pierre, Antoine and I are getting together in London a week from today, and we’re getting together in Paris the week after. We’re about to dig in aggressively about all the ways we can grow the business together and all the projects we can do together.

Now that Mediawan has built significant scale through this acquisition to form a global production group in the U.S., are you considering expanding into distribution, or do you intend to remain a pure production player?

Capton: Over at Mediawan, we have only one distribution arm in Germany with Leonine. So we will discuss with Peter whether it makes sense to strengthen our position in terms of distribution. But in U.S., we want to become a studio, and it’s part of Peter’s strategy as well.

Chernin: One of the things that we’ve been missing for a long time is that we haven’t had a distribution company. We actually considered acquiring some assets over the years, but it has been a missing piece in our company. And it’s one of the many things that’s attractive to us about this merger is being part of a global distribution company, both in television and films.

How do you expect the Netflix–Warner Bros. deal will reshape the landscape for independent production companies?

Chernin: First off, both companies are good friends of ours and we are major suppliers to both of them. And so we look forward to dealing with both of them. We do think that as part of any deal considerations, independent production is very important and the health of independent production companies is crucial, not only financially, but creatively. We will have ongoing conversations with everybody, but these are all our business partners and our friends, and so we will have constructive conversations with everybody.

Capton: We have also good relations with both of them and as Peter said, it’s important to preserve independent producers and their creativity.

Pierre-Antoine, are you looking to make other acquisitions in the U.S.?

Capton: We just signed this deal with North Road two days ago. So right now our priority is to start working together and continue to create. Ultimately, Mediawan wants to attract the best independent producers and creative talent. And of course, we will be agile in case of new potential acquisitions or partnerships.

And Peter, you’re also going to become a member of the Mediawan board?

Chernin: Honestly, the more important thing is my relationship with Pierre Antoine. You know, I look at him as my partner and I will do anything I can to help him and help the company grow. Those things are more impactful on a personal and daily level with Pierre-Antoine and Elisabeth d’Arvieu (Mediawan’s CCO) and Guillaume Izabel (Mediawan’s CFO). I will support and help the company in any way I can in any way they ask me to. But my instinct is that’s more likely to be on a daily personal basis with Pierre Antoine and his team, KKR, Xavier Niel, Matthew Pigasse, all of them.

The New York Times reported that the transaction is largely stock-based and values North Road at around $900 million. Is that accurate?

Chernin: I would say the part about stock is accurate, the other part I have no comment on.

You’re also becoming a shareholder of Mediawan through this deal.

Chernin: Yes, I guess I’m now a big shareholder of Mediawan, and so I have a big incentive, too. This isn’t me or North Road cashing out. In some ways, this is us investing in Mediawan and I think it’s an indication of our belief in the company and the growth opportunity.

Capton: And for us, it’s not only the acquisition of North Road that makes sense, it’s also the opportunity it gives us to work as partners with Peter. He’s a genius in so many ways and having him as a key shareholder, partner and associate, and being able to discuss with him every day or every week to be aligned on our strategy, will undeniably bolster Mediawan’s growth.