Netflix announced that it had over 325 million subscribers worldwide by the end of 2025, up from 301.2 million the previous year.

The company exceeded financial expectations for the fourth quarter of 2025. Netflix reported quarterly revenue of $12.05 billion (up 17.6%) and net income of $2.41 billion (up 29.4%), translating to 56 cents per share. On average, Wall Street analysts expected Netflix to report fourth-quarter revenue of $11.97 billion and earnings of 55 cents per share, according to LSEG Data & Analytics.

Netflix has stopped reporting subscriber numbers on a quarterly basis, but said it would do so when it reaches certain milestones.

“We have more than 325 million paying members and currently serve nearly 1 billion viewers worldwide,” the company said in its fourth-quarter shareholder letter. In the second half of 2025, Netflix users watched a total of 96 billion hours of the service, an increase of 2% year over year (up 1% in the first half of 2025). This was driven by viewing of Netflix Originals, which grew 9% year over year in the second half of 2025.

The company expects content amortization to increase by about 10% in 2026, indicating the company’s content spending will reach about $20 billion annually (up from about $18 billion last year). Growth in content spending will be even higher in the first half of this year. As a result, “we expect higher operating profit growth in the second half of 2026 than in the first half,” Netflix said.

In addition to increasing spending on original titles, Netflix plans to expand its lineup of licensed titles in 2026. Starting this month, Netflix customers will be able to watch new live-action movies under a new U.S. licensing partnership with Universal Studios. The company also said it has licensed approximately 20 shows from Paramount Skydance, including “Matlock” and “The King of Queens” for international territories, and “Seal Team,” “Watson” and “The Mayor of Kingstown” for U.S. and international territories. Additionally, Netflix has called for a deal to expand its recently announced paid single license agreement with Sony Pictures Entertainment into a worldwide deal. Netflix launched video podcasts this month from partners like Spotify and iHeartMedia and has hosted more than 200 live events to date, co-CEO Ted Sarandos said in a fourth-quarter earnings interview.

Netflix also revealed its advertising revenue for the first time. In 2025, the company’s third year of advertising sales, advertising revenue was more than $1.5 billion, more than 2.5 times more than in 2024.

Netflix projects 2026 revenue of $50.7 billion to $51.7 billion, which would represent a 12% to 14% year-over-year increase (or 11% to 13% growth at constant currency). This includes that advertising revenue is expected to double by 2026.

The earnings report came on the same day that Netflix announced it would strengthen its $83 billion deal to acquire Warner Bros.’ Discovery studios and HBO Max’s streaming business by converting it into an all-cash offer, replacing the previous cash and stock deal. The changes were driven by pressure from Paramount Skydance, which is pursuing a hostile takeover attempt for Warner Bros. Discovery, arguing that it is a favorable deal for WBD shareholders.

In a victory for the industry, Netflix executives struck a deal with Warner Bros. that enlarged the streamer’s content production engine, despite opposition from theater owners and others. To allay Hollywood’s concerns that Netflix would abandon theatrical distribution, co-CEO Ted Sarandos said last week that Netflix would maintain a 45-day theatrical release window for WB movies.

“Together, Netflix and Warner Bros. will offer broader choice and greater value to viewers around the world, enhancing access to world-class television and movies both at home and in theaters,” Sarandos said in a statement early Tuesday. “This acquisition also significantly expands our U.S. production capabilities and investment in original programming, driving job creation and long-term industry growth.”

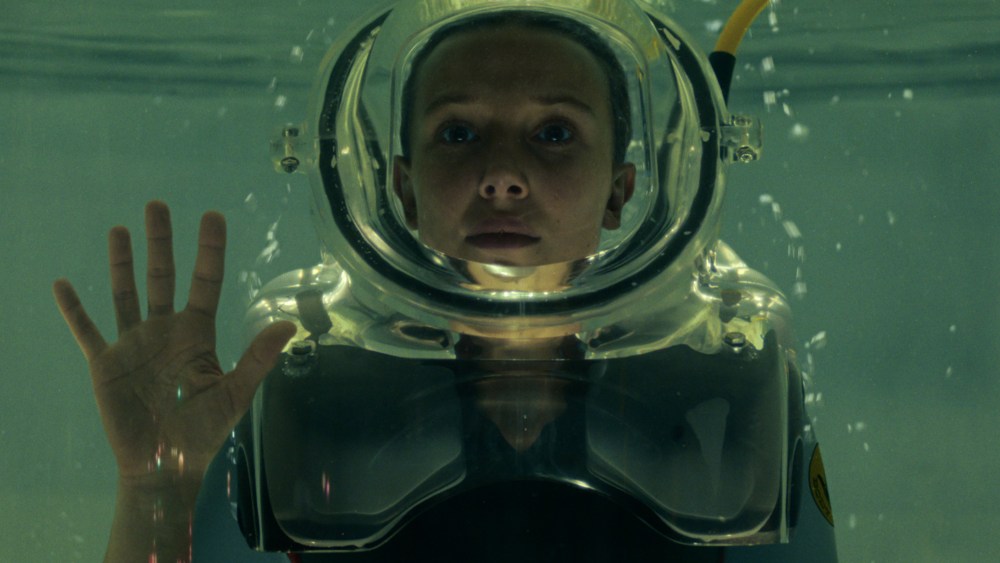

In the fourth quarter, Netflix saw strong traffic for the final season of the Duffer brothers’ ’80s-set supernatural drama series, “Stranger Things 5,” and the NFL doubleheader on Christmas drew significant live viewership.

Regarding competition, Netflix told shareholders that “TV consumption patterns are constantly evolving, and the lines of competition are becoming increasingly blurred.”

Part of Netflix’s message about competition is aimed at downplaying the increased market power it would have if it struck a deal with WBD to buy Warner Bros. Studios and HBO Max. Netflix is positioning its competitive set in terms of overall TV viewing, not just streaming. According to Nielsen, Netflix’s share of U.S. TV viewing time reached an all-time high of 9.0% in December 2025 (up 0.5 percentage points year-over-year), but the company noted that linear TV still accounts for more than 40% of total viewing time.

Netflix noted that several services are distributing content “simultaneously to both their linear channels and streaming services,” citing the 2026 Golden Globes being available simultaneously on CBS and Paramount+ and last year’s Super Bowl being simulcast on Fox and Tubi. The company also said that “YouTube has been leaning into TV in recent years by adding live professional sports coverage and will become the global home of the Oscars starting in 2029,” while “Instagram is bringing Reels to TV with a new app.”